Bengen is a retired financial adviser who first articulated the 4 withdrawal rate four percent rule as a rule of thumb for withdrawal rates from retirement savings in bengen 1994.

Bengen s floor ceiling rule.

One of my favorites is actually from bill bengen and he s the one who created the 4 rule initially.

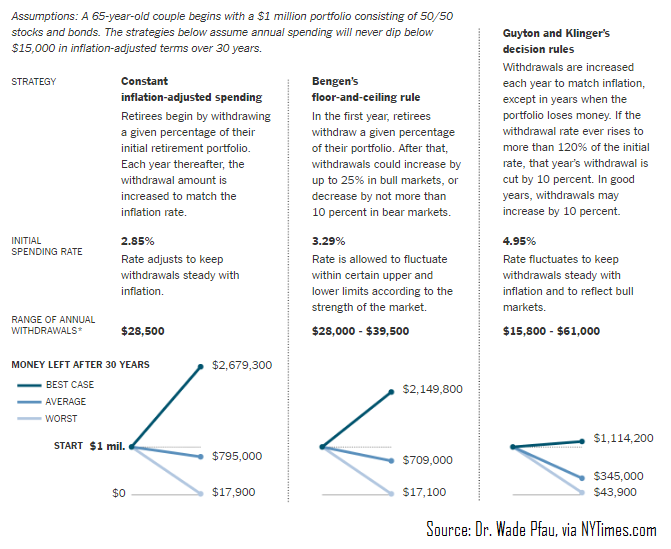

The bengen floor and ceiling rule lets you spend 15 more initially at the start of retirement and then if markets don t as you expect your spending drops back to where you would be if just.

Bengen s hard dollar floor and ceiling approach.

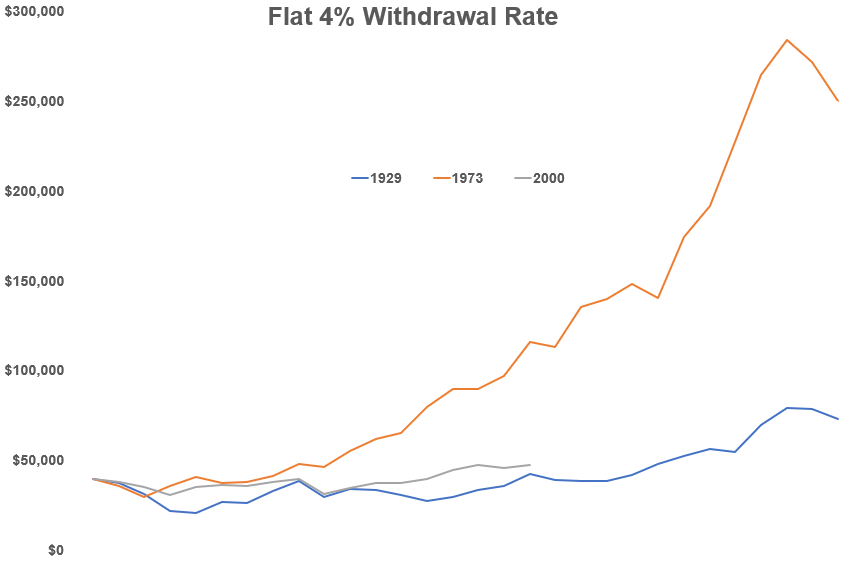

For 4 initial spending rate 50 50 asset allocation rolling 30 year retirements.

For 4 initial spending rate 50 50 asset allocation rolling 30 year retirements.

You may be interested to know that in 2001 bengen offered a new twist to the 4 percent rule proposing an updated strategy called the floor and ceiling method.

Vanguard s percentage floor and ceiling approach.

Here s how it works.

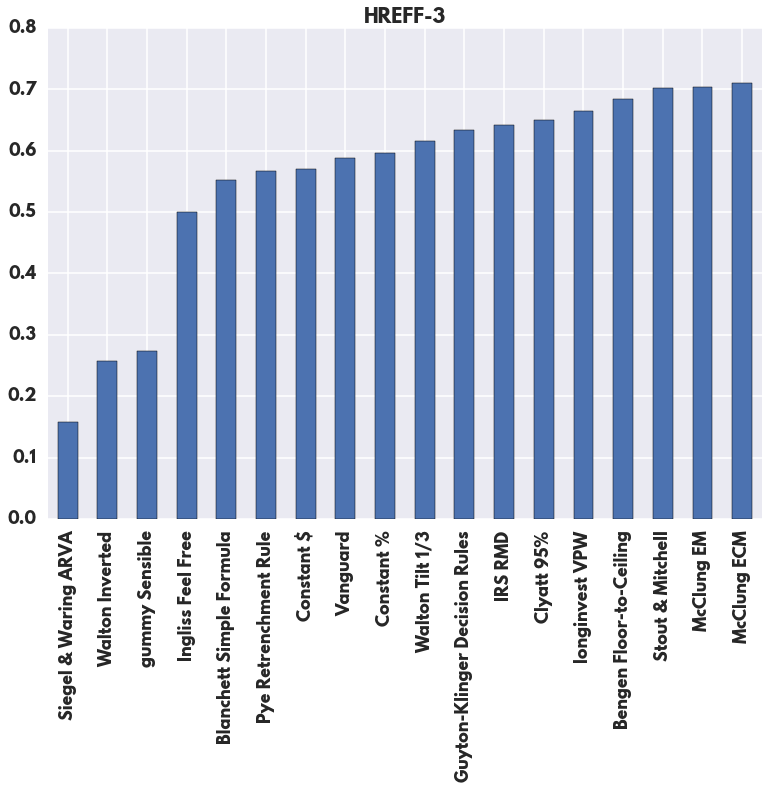

New dynamic adjustment methods for retirement withdrawal rates have been developed after bengen s 4 withdrawal rate was proposed.

Vanguard s percentage floor and ceiling rule.

More complex withdrawal strategies have also been created.

By using a more diversified portfolio.

Using sbbi data 1926 2015 s p 500 and intermediate term government bonds.

It is eponymously known as the bengen rule.

But he talked about a floor and ceiling approach where you spend a fixed percentage of what.

While including a floor on how far spending can fall opens the possibility of wealth depletion it becomes increasingly unlikely as the minimal floor decreases.

Bengen s original paper was published the 4 percent concept has been replicated expanded criticized and even refined by mr.

The rule was later further popularized by the trinity study 1998 based on the same data and similar analysis.

Bengen s hard dollar floor and ceiling rule.

Much like the 4 percent rule the retiree would start off their retirement using some safe percentage of the initial nest egg balance as the baseline.

Next read how long can retirees expect to live once they hit 65.

Constant inflation adjusted spending bengen s floor and ceiling rule and guyton and klinger s decision rules.

Bengen s hard dollar floor and ceiling rule.

Exhibit 7 6 time path of real spending and wealth.